DanBAN Selection Process

We have illustrated 6 main steps in the process at DanBAN. You can read about the 6 steps below and also see a selection of the companies that DanBAN members have invested in.

6 Steps - DanBAN Selection

1. Application

To be considered for an investment, you must upload your case via our deal platform, Dealum. We ask for some information about your company and a pitch deck. Apply by clicking on the icon above.

2. Pre-screening

If we assess that your startup meets our criteria, you will be made visible to all our members in DanBAN on our online deal platform, Dealum. After that, our members (investors) can contact you directly.

3. Feedback Meeting with Investor Relations Manager

In addition to being visible to our network, you will be invited to an initial feedback meeting with one of our Investor Relations Managers. We continuously select startups for our many pitch events.

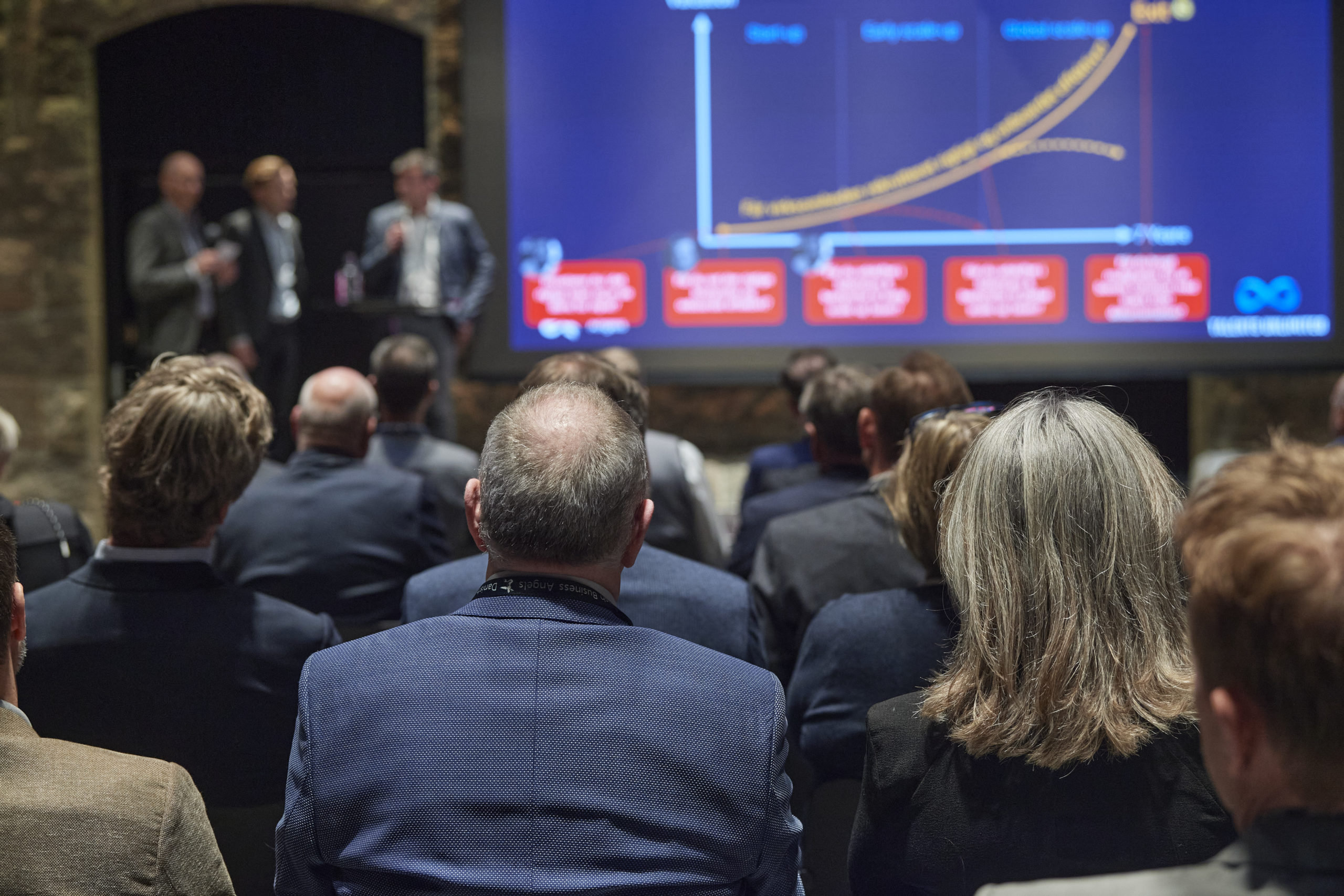

4. Pitch Event

Approximately 1-2 times a month, we hold a pitch event (both physical and online) where around 6 startups have the opportunity to present their case to our members (investors).

5. Due Diligence

If you receive interest from our members after our pitch events, one of our Investor Relations Managers will facilitate a follow-up meeting with the interested investors.

If there is continued interest after this meeting, a Due Diligence process begins, where interested investors will ask further questions and gain a better understanding of your company.

In most cases, 1-2 investors will be selected to lead the Due Diligence process (project manager). This is to ensure an efficient process with few points of contact.

6. Investment 🎉

If all areas in the Due Diligence process have a positive outcome, a term sheet will be prepared and signed, and then the investment will be completed.

Previous DanBAN Investments

Here is a selection of some of the companies that DanBAN members have invested in.