DanBAN Udvælgelsesprocessen

Vi har illustreret 6 overordnede trin for processen hos DanBAN. Du kan læse om de 6 trin nedenfor og samtidig se et udpluk af de selskaber, som DanBAN medlemmer har investeret i.

6 Trin - DanBAN udvælgelse

1. Ansøgning

For at komme i betragtning til en investering, skal I uploade jeres case via. vores dealplatform, Dealum. Her beder vi om nogle informationer omkring jeres virksomhed samt et pitch deck. Ansøg ved at klikke på ikonet ovenfor.

2. Pre-screening

Såfremt vi vurderer at jeres startup lever op til vores kriterier, så vil I på vores online deal-platform, Dealum, blive gjort synlige for alle vores medlemmer i DanBAN. Herefter kan vores medlemmer (investorer) selv tage kontakt til jer.

3. Feedback møde med Investor Relations Manager

Udover at være synlige for vores netværk, så vil I blive inviteret til et indledende feedback møde med en af vores Investor Relations Managers. Vi udvælger løbende startups til vores mange pitch events.

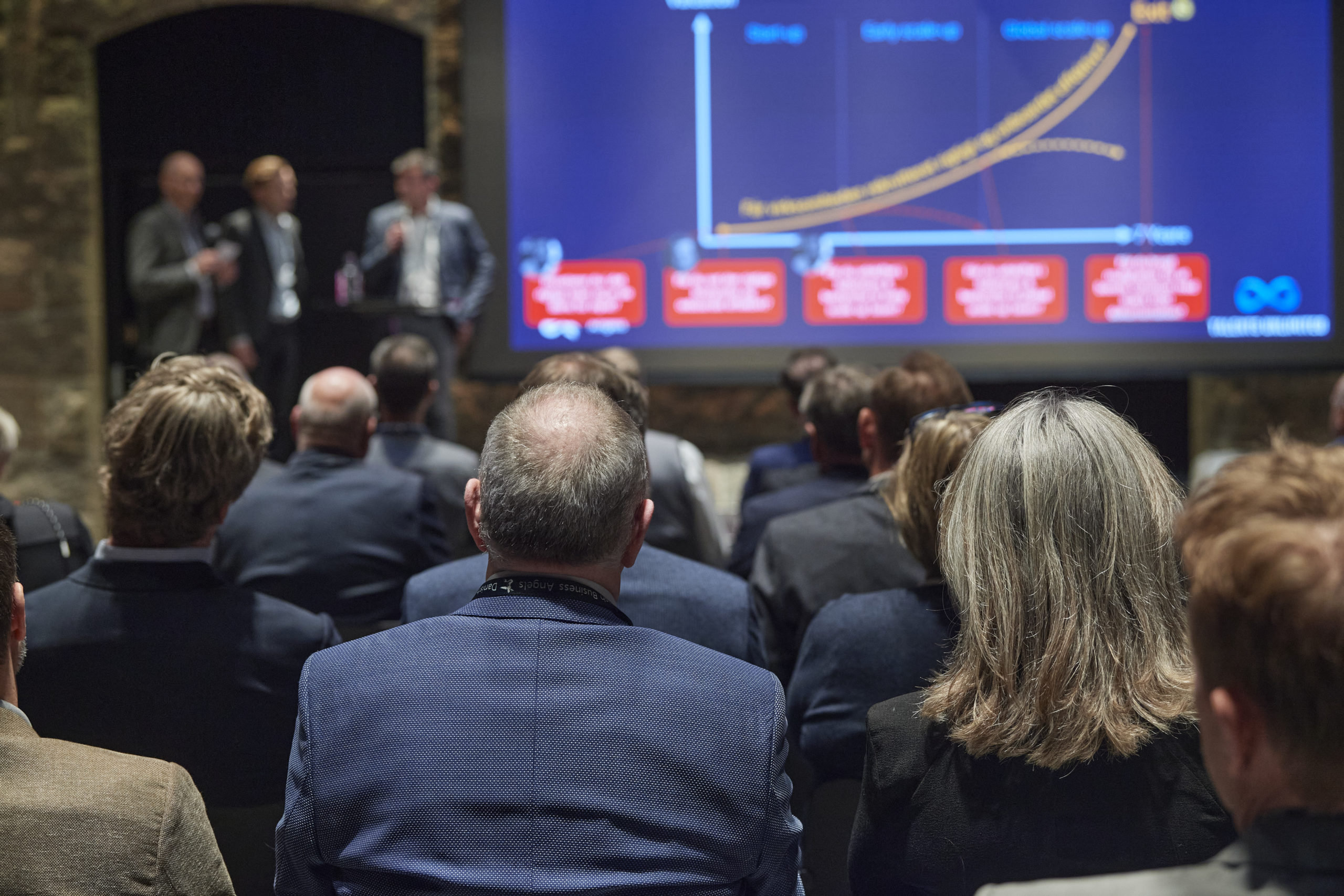

4. Pitch Event

Ca. 1-2 gange om måneden afholder vi et pitch event (både fysisk og online) hvor ca. 6 startups får mulighed for at præsentere deres case for vores medlemmer (investorer).

5. Due Diligence

Hvis I modtager interesse fra vores medlemmer efter vores pitch events, så faciliterer en vores Investor Relations Managers et opfølgende møde med de interesserede investorer.

Ved fortsat interesse efter dette møde, så starter en Due Diligence proces, hvor interesserede investorer vil stille yderligere spørgsmål og skabe en bedre forståelse for jeres virksomhed.

I de fleste tilfælde vil der udpeges 1-2 investorer, som tager lead på Due Diligence processen (tovholder). Det er for at sikre en effektiv proces med få kontaktpersoner.

6. Investering 🎉

Hvis alle områder i Due Diligence processen er med positivt udfald, så vil der blive udarbejdet term-sheet og underskrevet, hvor efter investeringen gennemføres. ,

Tidligere DanBAN investeringer

Her ses et udpluk af nogle af de selskaber som DanBAN medlemmer har investeret i.